Seagate Stock Hits Record High on AI-Driven Earnings Blowout: Why Western Digital and SanDisk Are Joining the Rally

By George Osbourne lf Wednesday, January 28, 2026

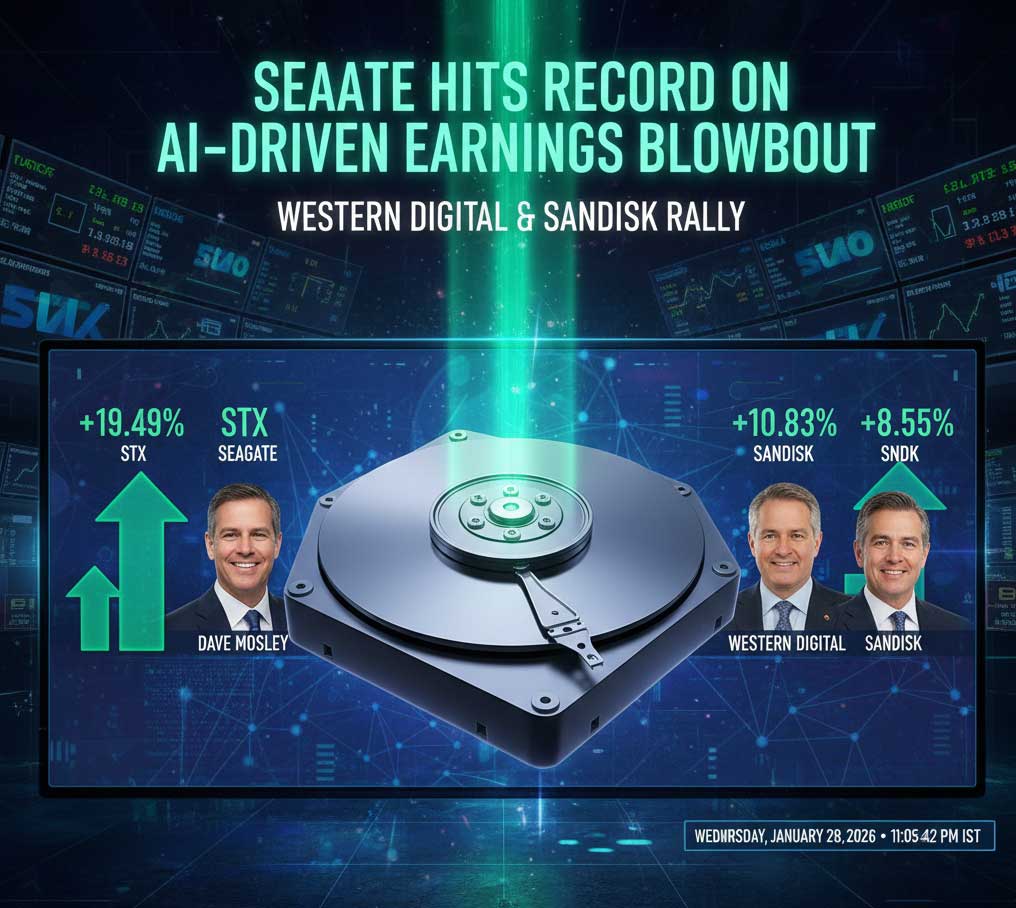

CUPERTINO, Calif. — The artificial intelligence “gold rush” has found its latest breakout beneficiary: the unglamorous but essential world of mass-capacity storage. Seagate Technology Holdings (STX) saw its stock skyrocket to an all-time record on Wednesday, gaining nearly 20% in mid-day trading after reporting fiscal second-quarter earnings that shattered analyst expectations.

The surge didn’t stop at Seagate. The entire storage sector is catching fire, with Western Digital (WDC) and the recently spun-off SanDisk (SNDK) both rallying double digits. The catalyst? A fundamental shift in how AI data centers are built, shifting the focus from just “compute” (GPUs) to “capacity” (Exabytes).

Seagate’s “Perfect Storm” of Profitability

For years, the hard-disk drive (HDD) market was viewed as a declining legacy business, destined to be replaced by faster flash storage. However, the sheer volume of data required to train and run Large Language Models (LLMs) has breathed new life into high-capacity spinning disks.

The Q2 Numbers at a Glance:

Seagate reported a blowout quarter ending January 2, 2026, characterized by record-breaking margins and a massive EPS beat.

- Revenue: $2.83 billion (vs. $2.73 billion expected)

- Non-GAAP EPS: $3.11 (vs. $2.83 consensus)

- Gross Margin: A record 42.2% (up from 35.5% a year ago)

- Free Cash Flow: $607 million

“Seagate’s results highlight the durability of data center demand,” said CEO Dave Mosley during the analyst call. “As AI applications amplify the economic value of data, modern data centers need storage solutions that combine performance and cost-efficiency at exabyte-scale.”

Getty Images

The star of the show was Seagate’s Mozaic 3+ platform, which utilizes Heat-Assisted Magnetic Recording (HAMR) technology. By using lasers to heat the disk surface during writing, Seagate has been able to pack over 30TB into a single drive, offering hyperscalers like Microsoft and Google the density they crave without increasing power consumption.

The Industry-Wide Rally: WDC and SNDK

While Seagate is the king of HDDs, its performance acted as a “rising tide” for its peers. Western Digital shares climbed 10.8% to $280.02, while SanDisk—which operates as a pure-play flash storage company since its 2025 spinoff—jumped 8.5% to cross the $522 mark.

Why Western Digital is Surging:

Western Digital benefits from a “dual-engine” strategy. It remains a major player in the HDD market alongside Seagate, but its exposure to NAND flash (via its joint venture with Kioxia) allows it to capture the high-speed storage market.

- The Catalyst: Analysts noted that HDD lead times are now ballooning to over a year, giving WDC massive pricing power.

- Earnings Momentum: WDC recently reported its own beat with $1.78 EPS vs. the $1.57 expected, signaling that the storage recovery is structural, not just a one-off for Seagate.

The SanDisk Phenomenon:

SanDisk (SNDK) has become the “AI king” of the memory world in 2026. Since its spinoff in February 2025, the stock has skyrocketed over 1,000%.

- Shortages: Memory prices are projected to hike 70% in early 2026 as Samsung and SK Hynix divert production to High-Bandwidth Memory (HBM).

- Pure Play: Investors are treating SNDK as a pure-play bet on enterprise SSDs, which are essential for AI “inference”—the stage where AI models actually answer user prompts.

Market Dynamics: The Storage Bottleneck

The rally is underpinned by a harsh reality for tech buyers: the world is running out of storage.

| Metric | 2026 Projection |

| Data Center Chip Share | Data centers will consume 70% of all high-end memory. |

| Memory Price Hike | Prices expected to rise 40-50% by end of Q1 2026. |

| HDD Lead Times | Currently exceeding 12 months for certain 30TB+ models. |

Export to Sheets