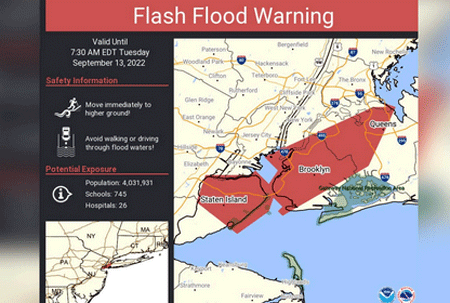

BREAKING NEWS: Flash Flood Warning Issued for NYC Area

A flash flood warning has been issued for New York City and surrounding areas, including the Bronx, Brooklyn, Manhattan, Queens, and Westchester County, effective until 5:30 p.m. Thursday.

Heavy thunderstorms are causing flash flooding, with 1-2 inches of rain already fallen and an expected additional 1-2 inches possible. Locations impacted include Jamaica, Yonkers, Flushing, White Plains, and major airports.

The National Weather Service warns of flash flooding on small creeks and streams, urban areas, highways, and low-lying areas. Motorists are urged to “turn around, don’t drown” and avoid flooded roads. Residents are advised to move to higher ground and report observed flooding to local emergency services.

YOU MAY ALSO LIKE TO READ

Flood insurance claims can be complex and overwhelming, especially when dealing with insurance companies. Here’s a comprehensive guide to help you navigate the process, including tips on how to claim with an attorney or lawyer.

Understanding Flood Insurance

Flood damage is typically not covered by standard homeowners’ insurance policies. You need a separate flood insurance policy, often provided by the National Flood Insurance Program (NFIP) or private insurers. Review your policy to understand what’s covered and what’s not.

Filing a Flood Insurance Claim

To file a claim, follow these steps ¹ ²:

- Contact your insurance company: Call the claims number immediately to start the process.

- Document damage: Take photos and videos of the damage, including high-value items.

- Prevent further damage: Make minor repairs to prevent further damage.

- Cooperate with the adjuster: Meet with the insurance adjuster and provide required documents.

Tips for Maximizing Your Claim

- Keep detailed records: Document everything, including correspondence with your insurance company.

- Take photos and videos: Capture evidence of the damage and affected areas.

- Store damaged items safely: Keep damaged items for inspection by the insurance adjuster.

- Get written estimates: Obtain repair estimates from reputable contractors ³ ¹.

When to Hire a Flood Damage Lawyer

If your claim is denied or underpaid, consider hiring a flood damage lawyer. They can help you:

- Understand your policy: Interpret policy language and identify coverage.

- Negotiate with the insurer: Advocate for fair compensation.

- File an appeal: Challenge denied claims or underpaid settlements.

Top Flood Damage Law Firms

Some notable law firms specializing in flood damage claims are ⁴ ⁵ ⁶:

- Ged Lawyers: Experienced in handling flood damage claims and negotiating with insurance companies.

- Florin|Roebig: Top-rated insurance law firm with expertise in flood damage and property insurance claims.

- Morgan & Morgan: Insurance dispute attorneys fighting for policyholders’ rights.

- Merlin Law Group: Advocates for policyholders with experience in insurance claims and litigation.

- Williams Law: Specializes in insurance claims, including flood damage and denied claims.

Common Reasons for Claim Denials

- Policy exclusions: Claims falling under specific exclusions, such as certain natural disasters.

- Lapsed coverage: Failure to maintain coverage.

- Insufficient documentation: Lack of evidence to support the claim.

- Policy misinterpretation: Twisting policy language to justify denial ⁶.

Appealing a Denied Claim

If your claim is denied, you can:

- File an internal appeal: Challenge the denial with your insurance company.

- Escalate to a supervisor: Request a review by a higher authority.

- Hire a public adjuster: Independent professionals who can help negotiate with the insurer.

- File a lawsuit: Pursue legal action against the insurance company ¹ ².

By understanding your policy, documenting damage, and seeking professional help when needed, you can navigate the complex process of filing a flood insurance claim and ensure fair compensation for your losses.