Disney and Fubo finalize Merger, Creating Sixth-Largest Pay TV Company in the USA

The Walt Disney Company and Fubo have officially closed their deal to merge Hulu + Live TV operations with Fubo, creating a new entity that becomes the sixth-largest pay TV company in the US with nearly 6 million subscribers. Disney will retain a 70% stake in the new company, while Fubo’s existing shareholders will own approximately 30%. The merger combines the strengths of both services, offering over 55,000 live sporting events annually and a robust entertainment lineup.

Key Highlights of the Merger

- Combined Subscribers: The new entity has nearly 6 million subscribers, positioning it just behind YouTube TV, which has over 10 million paying subscribers.

- Operational Structure: Fubo and Hulu + Live TV will continue to operate as separate services with multiple plan options, including skinny and robust bundles.

- Advertising Synergies: Fubo’s advertising sales group will transition to Disney’s ad organization, enabling premium, data-driven experiences for viewers and brands.

- Financial Terms: Disney has committed to a $145 million term loan to Fubo in 2026, supporting future operations and innovation.

Impact on Consumers and the Market

The merger is expected to deliver enhanced value to consumers through more flexible programming options and improved advertising experiences. The combined entity will leverage the resources and support of Disney, driving growth and profitability. This strategic move positions the company to compete more effectively in the streaming market, particularly against industry giants like YouTube TV ¹ ².

Leadership and Governance

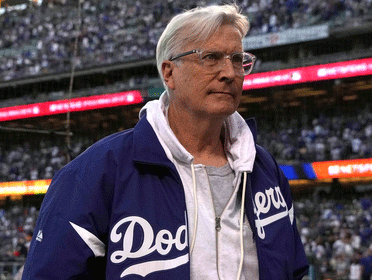

- David Gandler, Fubo’s Co-founder and CEO, will lead the combined company.

- Andy Bird, former Chairman of Walt Disney International, will serve as the independent chairman of the board, guiding the strategic direction of the new entity