Fed Likely to Cut Rates as Job Market Shows Signs of Weakness

The Federal Reserve is expected to lower interest rates by a quarter of a percentage point on Wednesday, marking the second consecutive rate cut. This decision aims to support the labor market and mitigate potential economic downturns.

Key Points to Watch:

- Interest Rate Cut: The Fed’s decision reflects its view that it can afford temporary higher inflation to support the labor market.

- Data Blackout: The government shutdown has limited access to official data, making it challenging for the Fed to gauge the economy’s performance.

- Job Market Worries: The labor market is considered vulnerable, and inflationary pressures tied to tariffs are a concern.

- Potential Dissent: The Fed’s vote may not be unanimous, with some officials potentially dissenting from the decision.

- Balance Sheet Unwind: The Fed may discuss ending its balance sheet unwind program, which has been reducing its holdings of Treasuries and mortgage-backed securities since 2022.

What to Expect:

- Rate Decision: The Fed will release its policy statement at 2 p.m. in Washington, followed by a news conference with Fed Chair Jerome Powell at 2:30 p.m.

- December Cut: Attention will focus on whether the Fed will follow through with another rate cut in December, as predicted by most officials.

- Economic Outlook: Powell will likely emphasize the labor market’s vulnerability and the potential risks associated with the government shutdown

Federal Reserve Set to Cut Interest Rates: What to Expect

The Federal Reserve is expected to lower interest rates by a quarter of a percentage point on Wednesday, marking the second consecutive rate cut. This decision aims to support the labor market and mitigate potential economic downturns.

Why is the Fed Cutting Interest Rates?

The Fed’s decision to cut interest rates is driven by concerns about the economy’s growth and the labor market. Recent indicators suggest that economic activity has moderated, and job gains have slowed. The unemployment rate has edged up, although it remains low. By cutting interest rates, the Fed aims to stimulate borrowing, investment, and economic growth.

Key Points to Watch

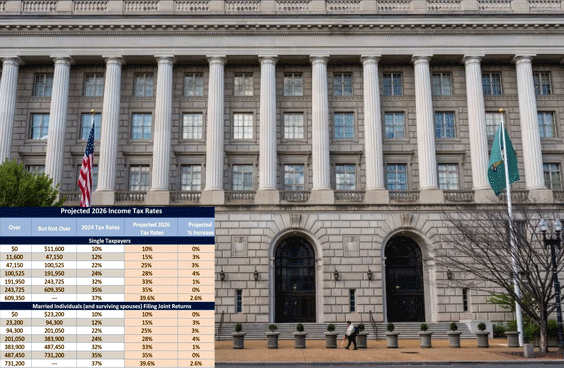

- Interest Rate Cut: The Fed is expected to lower the federal funds rate by 25 basis points, bringing it to a range of 4.00%-4.25%.

- Balance Sheet Unwind: The Fed may discuss ending its balance sheet unwind program, which has been reducing its holdings of Treasuries and mortgage-backed securities since 2022.

- Economic Uncertainty: The government shutdown has resulted in a data blackout, limiting the Fed’s access to official data and making it challenging to gauge the economy’s performance.

- Labor Market: The labor market is showing signs of vulnerability, and the Fed will likely emphasize the need for continued support.

What Does This Mean for Investors?

The Fed’s decision to cut interest rates will likely have significant implications for investors. Here are a few key takeaways ¹ ²:

- Stock Market: The stock market has been buoyed by the expectation of rate cuts, with the S&P 500 reaching record highs.

- Bond Market: The bond market is also likely to be affected, with yields potentially decreasing in response to the rate cut.

- Investor Sentiment: Investor sentiment will be closely tied to the Fed’s decision and the outlook for future rate cuts.

What’s Next?

The Fed’s decision will be closely watched by investors and economists, who will be looking for clues about the central bank’s future plans. With the economy facing significant uncertainty, the Fed’s actions will be crucial in determining the path forward.

Some key dates to watch include ²:

- December Meeting: The Fed’s next meeting is scheduled for December 10-11, where it will release its next “dot plot” outlining the committee’s expectations for interest rates.

- Economic Data: The government shutdown has resulted in a data blackout, but the Fed will be closely watching alternative metrics and surveys to gauge the economy’s performance.

Conclusion

The Federal Reserve’s decision to cut interest rates is a significant move that reflects the central bank’s efforts to support the economy. With economic uncertainty high, the Fed’s actions will be closely watched, and its future plans will be crucial in determining the path forward. Investors and economists will be eagerly awaiting the Fed’s policy statement and subsequent press conference with Chair Jerome Powell for insights into the central bank’s thinking and future plans.