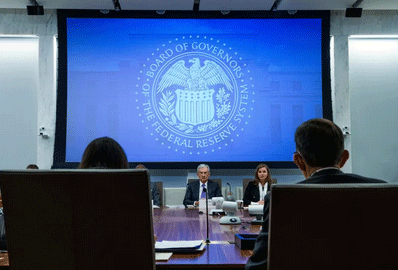

Federal Reserve Cuts Interest Rates to 3-Year Low Amid Government Shutdown

The Federal Reserve made a significant move on Wednesday, October 29, 2025, cutting its benchmark interest rate by a quarter point to a range of 3.75%-4.00%, the lowest level in three years. This decision comes amidst an ongoing federal government shutdown, which has severely limited the Fed’s access to key economic data, including inflation and jobs reports ¹.

Key Takeaways:

- Interest Rate Cut: The Fed’s decision marks the second consecutive rate cut this year, with the goal of supporting a gradually cooling labor market.

- Government Shutdown Impact: The shutdown has forced the Fed to make policy decisions with limited visibility, relying more heavily on private-sector indicators and qualitative assessments.

- Divergent Views: The decision was not unanimous, with two dissenting votes: Stephen Miran voted for a 50-basis-point cut, while Jeffrey Schmid favored holding rates steady due to ongoing inflation concerns ².

- Future Outlook: Fed Chair Jerome Powell signaled that a December rate cut is not a certainty, and the Fed will carefully assess incoming data before making further adjustments.

Market Reaction:

- Stock Market: The S&P 500 ended the day largely flat after giving up earlier gains, reflecting uncertainty about the economic outlook.

- Treasury Yields: The 10-year Treasury yield rose to 4.078% from 4.28% as rate cut expectations diminished.

- Dollar Index: The dollar index strengthened 0.4% as higher-for-longer rate expectations supported the currency ³.

Economic Implications:

- Labor Market: The Fed’s decision prioritizes supporting the labor market, which has shown signs of weakening.

- Inflation: Despite persistent inflation concerns, the Fed is focused on preventing further economic downturn.

- Government Shutdown: A prolonged shutdown could reduce annualized real GDP growth by 1.0 to 2.0 percentage points in Q4 2025, resulting in a permanent loss to the economy ¹.

What’s Next?

The Fed’s next meeting is scheduled for December 9-10, 2025. While markets currently assign a 90% probability to a rate cut in December, Fed Chair Powell’s comments suggest that the decision is far from certain. The outcome will depend on incoming economic data and the duration of the government shutdown.

Navigating the World of Finance: Tips and Tricks

Managing your finances can be overwhelming, but with the right guidance, you can achieve your goals. Here are some valuable tips to consider:

Finding the Right Financial Advisor

- Define Your Needs: Before searching for a financial advisor, determine what services you require. Do you need investment advice, tax planning, or retirement planning?

- Get Referrals: Ask friends, family, or colleagues for recommendations. You can also search online or check professional associations like the Financial Planning Association (FPA) or the National Association of Personal Financial Advisors (NAPFA).

- Check Credentials: Ensure your advisor has the necessary certifications, such as CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst).

Tax Planning and Accounting

- Hire a Tax Professional: A tax professional can help you navigate complex tax laws and ensure you’re taking advantage of available deductions and credits.

- Keep Accurate Records: Maintain detailed records of your income, expenses, and financial transactions to simplify tax preparation and potential audits.

- Consider Outsourced Tax Preparation: If you’re a small business owner, consider outsourcing tax preparation to a professional to ensure accuracy and compliance.

Wealth Management and Investment

- Develop a Comprehensive Plan: Create a tailored financial plan that aligns with your goals and risk tolerance.

- Diversify Your Portfolio: Spread your investments across asset classes to minimize risk and maximize returns.

- Regularly Review and Adjust: Periodically review your portfolio and rebalance it as needed to ensure alignment with your goals.

Nonprofit and Small Business Considerations

- Specialized Accounting Services: Nonprofits and small businesses require specialized accounting services. Look for professionals with experience in your industry.

- Tax Debt Relief Programs: If you’re struggling with tax debt, explore relief programs or consider consulting a tax professional.

- Payroll Filing and Compliance: Ensure you’re compliant with payroll regulations and filing requirements to avoid penalties.

High-Net-Worth Individuals

- Private Wealth Management: Consider working with a private wealth manager to tailor a financial plan that meets your unique needs.

- Tax Planning Strategies: Explore tax planning strategies, such as individual pension plans or charitable giving, to minimize taxes and maximize wealth transfer.

- Investment and Advisory Services: Work with a financial advisor who offers investment and advisory services to help you achieve your financial goals.

Additional Tips

- Stay Informed: Continuously educate yourself on personal finance, investing, and tax planning to make informed decisions.

- Avoid Emotional Decisions: Make rational, data-driven decisions to avoid costly mistakes.

- Regularly Review Your Finances: Periodically review your financial situation to ensure you’re on track to meet your goals.

Finding the Right Professionals

- Virtual CPA Services: Consider virtual CPA services for convenience and flexibility.

- Nonprofit CPA Firms: Look for CPA firms specializing in nonprofits for tailored expertise.

- High-Net-Worth Tax Planning: Seek out professionals with experience in high-net-worth tax planning to minimize taxes and maximize wealth transfer.

By following these tips and working with the right professionals, you can achieve financial stability, security, and success. Remember to stay informed, avoid emotional decisions, and regularly review your finances to ensure you’re on track to meet your goals.

Resources:

- Financial Planning Association (FPA)

- National Association of Personal Financial Advisors (NAPFA)

- American Institute of Certified Public Accountants (AICPA)

- Internal Revenue Service (IRS)

Conclusion

Navigating the world of finance can be complex, but with the right guidance and strategies, you can achieve your financial goals. By working with a financial advisor, tax professional, or wealth manager, you can create a tailored plan that meets your unique needs and helps you build wealth over time. Stay informed, avoid emotional decisions, and regularly review your finances to ensure you’re on track to achieve financial succes