NFLX Stock Analysis: Netflix Faces a Murky Outlook as it Continues to Pursue Warner Bros. Discovery

NEW YORK — January 20, 2026

The streaming wars have entered a volatile new chapter, and at the center of the storm is NFLX stock. As Netflix prepares to report its fourth-quarter earnings after the closing bell today, the narrative surrounding the world’s leading streaming service has shifted from content dominance to a high-stakes, $72 billion gamble.

While the fundamental business of Netflix remains a powerhouse—buoyed by the cultural phenomena of Stranger Things and Squid Game—the company’s aggressive pursuit of legacy media titan Warner Bros. Discovery (WBD) has cast a long shadow over its valuation. For investors, today’s earnings report isn’t just about subscriber counts; it’s about whether Netflix can survive its own ambition.

The $72 Billion Question: Why Warner Bros. Discovery?

The announcement on December 5 that Netflix intended to acquire WBD for $72 billion sent shockwaves through Wall Street. Since that day, NFLX stock has plunged 15%, significantly underperforming the S&P 500. The market’s skepticism is rooted in three primary concerns:

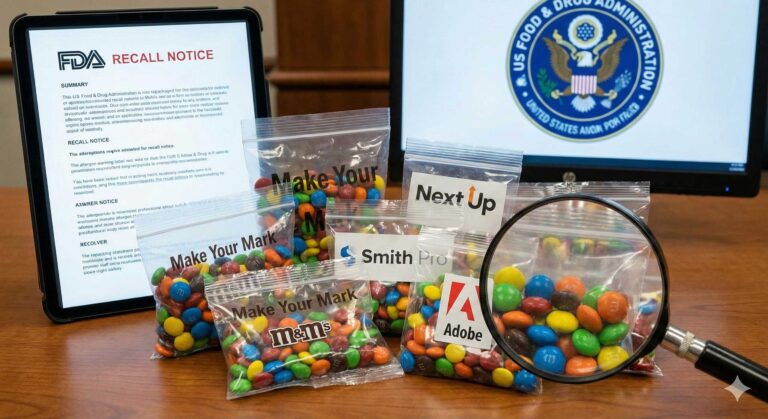

- Cultural Integration: This marks Netflix’s first major acquisition. Critics argue that the agile, tech-first “growth mindset” of Netflix may clash violently with the bloated, traditional infrastructure of a legacy studio like Warner Brothers.

- The Debt Burden: To finalize a deal of this magnitude, Netflix would have to load its balance sheet with an unprecedented amount of debt, threatening the free-cash-flow stability it worked so hard to achieve post-pandemic.

- Regulatory Hurdles: The Trump administration poses a significant “wildcard” risk. Oracle’s Larry Ellison—a close ally of the President—is currently backing his son David Ellison and Paramount’s hostile bid for Warner Bros. This political entanglement could lead to the deal being squashed in Washington

NFLX Stock Analysis: Netflix Faces a Murky Outlook as it Continues to Pursue Warner Bros. Discovery

NEW YORK — January 20, 2026

The streaming wars have entered a volatile new chapter, and at the center of the storm is NFLX stock. As Netflix prepares to report its fourth-quarter earnings after the closing bell today, the narrative surrounding the world’s leading streaming service has shifted from content dominance to a high-stakes, $72 billion gamble.

While the fundamental business of Netflix remains a powerhouse—buoyed by the cultural phenomena of Stranger Things and Squid Game—the company’s aggressive pursuit of legacy media titan Warner Bros. Discovery (WBD) has cast a long shadow over its valuation. For investors, today’s earnings report isn’t just about subscriber counts; it’s about whether Netflix can survive its own ambition.

The $72 Billion Question: Why Warner Bros. Discovery?

The announcement on December 5 that Netflix intended to acquire WBD for $72 billion sent shockwaves through Wall Street. Since that day, NFLX stock has plunged 15%, significantly underperforming the S&P 500. The market’s skepticism is rooted in three primary concerns:

- Cultural Integration: This marks Netflix’s first major acquisition. Critics argue that the agile, tech-first “growth mindset” of Netflix may clash violently with the bloated, traditional infrastructure of a legacy studio like Warner Brothers.

- The Debt Burden: To finalize a deal of this magnitude, Netflix would have to load its balance sheet with an unprecedented amount of debt, threatening the free-cash-flow stability it worked so hard to achieve post-pandemic.

- Regulatory Hurdles: The Trump administration poses a significant “wildcard” risk. Oracle’s Larry Ellison—a close ally of the President—is currently backing his son David Ellison and Paramount’s hostile bid for Warner Bros. This political entanglement could lead to the deal being squashed in Washington

Jefferies analyst James Heaney warned that if FY26 revenue guidance comes in below 13%, confidence in the organic Netflix story could evaporate, especially given the heightened scrutiny following the WBD bid.

The Hostile Bid: A Three-Way Fight for Media Supremacy

Netflix isn’t the only suitor at the table. The battle for Warner Bros. Discovery has become a proxy war between tech giants and legacy media families:

- Netflix (NFLX): The $72 Billion cash-and-stock offer.

- Paramount (PSKY) / David Ellison: Backed by Oracle’s Larry Ellison; a hostile bid that enjoys potential political favor.

- The Status Quo: WBD leadership remains divided on whether to sell or remain independent amid shrinking linear TV revenues.

- As the market waits for the 4:00 PM ET earnings release, the volatility in NFLX stock reflects a company at a crossroads. Can Netflix evolve into a diversified media conglomerate, or will the weight of the “Pardon Marketplace” of Hollywood deals drag down its once-stellar growth?

- WATCH LIVE: Click here to join the Yahoo Finance Netflix Earnings Call Livestream and see the instant reaction to NFLX stock.