The Invisible Grounding: How a Global Parts Shortage is Stalling African Skies

For the better part of the last decade, the narrative surrounding African aviation was one of unbridled optimism. With the launch of the Single African Air Transport Market (SAATM) and the ambitious African Continental Free Trade Area (AfCFTA), the continent was poised to become the world’s next great aviation frontier.

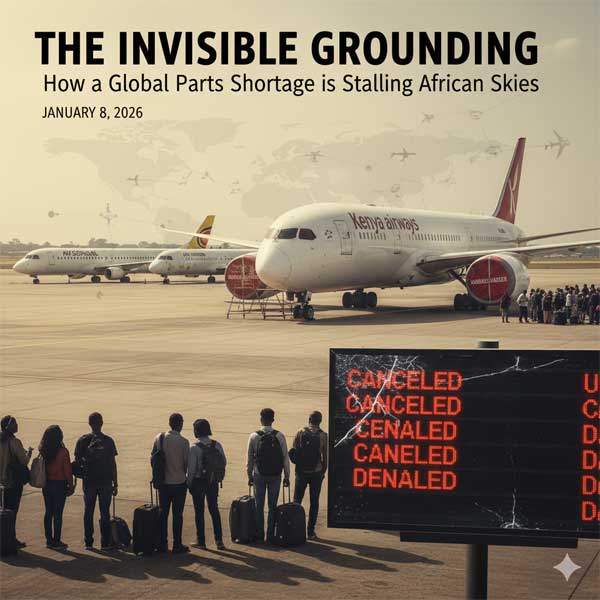

However, as of January 8, 2026, a new and quieter crisis has emerged. It isn’t a lack of passengers or high fuel prices—though those remain challenges—but a desperate, worldwide shortage of plane spare parts. From Dakar to Entebbe, aircraft are sitting idle on tarmacs, not because they are obsolete, but because they are waiting for a single sensor, a turbine blade, or a certified bolt.

The $11 Billion Price Tag

A recent study by the International Air Transport Association (IATA) has sent shockwaves through the industry. The report estimates that global supply chain disruptions—fueled by labor shortages in manufacturing, geopolitical instability affecting raw materials like titanium, and a massive backlog at major OEMs (Original Equipment Manufacturers)—could cost the aviation industry upwards of $11 billion this year alone.

For African carriers, which operate on the thinnest of margins, this is not just a financial hurdle; it is an existential threat. IATA breaks down the global $11 billion drain into four painful categories:

- $4.2 billion in delayed fuel savings (airlines are forced to fly older, thirstier planes).

- $3.1 billion in ballooning maintenance costs.

- $2.6 billion in excess engine leasing fees.

- $1.4 billion in surplus inventory costs as airlines “panic-buy” parts to avoid future groundings.

Airlines in the Crosshairs: Air Senegal, Kenya Airways, and Uganda Airlines

The crisis is most visible among the continent’s regional players. While industry giants like Ethiopian Airlines have the scale to lease “rescue” aircraft, smaller national carriers are struggling to keep their schedules intact.

Kenya Airways (KQ)

The “Pride of Africa” has been particularly hard hit. In late 2025, Kenya Airways reported significant losses, partly attributed to the grounding of multiple Boeing 787 Dreamliners. At one point, nearly 20% of their wide-body capacity was out of service due to a lack of General Electric (GEnx) engine components. This led to the postponement of highly anticipated routes, such as the direct Nairobi-to-Beijing service, now pushed to 2026.

Uganda Airlines & Air Senegal

Similarly, Uganda Airlines and Air Senegal have seen their expansion plans “clipped.” With at least one aircraft from each of their relatively small fleets grounded over the past year, these carriers have faced a wave of cancellations and delays. In the aviation world, a grounded plane is a “black hole” for cash—it continues to accrue leasing and insurance costs while generating zero revenue.

The “Tourism Cloud”: A Threat to the Wider Economy

The ripple effects extend far beyond the airport perimeter. Africa’s tourism sector is the secondary victim of this “parts famine.”

Tourism depends on reliability. When international travelers face “uncertainties that becloud flight bookings”—as the IATA report warns—they tend to look elsewhere. A canceled flight from Paris to Dakar due to “technical issues” (code for a missing spare part) doesn’t just lose a ticket sale; it loses a hotel booking, a tour guide’s wage, and a local artisan’s sale.

A Silver Lining: The Catalysts for 2026 and Beyond

Despite the grim current reality, industry experts maintain that the medium-to-long-term outlook for African aviation remains bullish. The “Intervening Years” (2026–2030) are expected to see growth driven by three powerful catalysts:

- The Rising Middle Class: Africa’s demographic dividend is real. A younger, more mobile population is increasingly choosing air travel over arduous land journeys.

- SAATM (The Single African Air Transport Market): Now boasting nearly 40 member states, SAATM is slowly dismantling the protectionist barriers that have made intra-African travel more expensive than flying to Europe.

- AfCFTA (African Continental Free Trade Area): By creating a single market for goods and services, AfCFTA is expected to increase intra-African freight demand by 28% by 2030. This will require an estimated 250 new aircraft dedicated specifically to trade routes.

The Path Forward: Localizing Maintenance

If there is a lesson to be learned from the 2026 parts crisis, it is that Africa cannot remain 100% dependent on foreign MRO (Maintenance, Repair, and Overhaul) hubs.

To bridge the gap, IATA and the African Airlines Association (AFRAA) are calling for:

- Regional MRO Hubs: Developing certified maintenance facilities in West and East Africa to reduce the need to fly planes to Europe or Asia for minor repairs.

- Parts Pooling: Strategic alliances between African airlines to share inventories of critical spares.

- Opening the Aftermarket: Lobbying OEMs to allow more third-party certified parts to be used, breaking the monopoly that currently keeps prices high and lead times long.

Final Thoughts

African aviation is currently navigating a “perfect storm” of high demand and low supply. While the $11 billion hit is a bitter pill to swallow, the fundamental drivers of the industry—trade, tourism, and a more connected continent—remain intact. If the continent can weather this supply chain turbulence, the skies of 2027 and 2028 look remarkably clear.