US Inflation Report Live: September CPI Edges Higher. Live Now

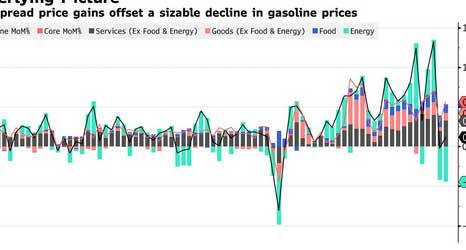

Breaking News : The US Bureau of Labor Statistics released its Consumer Price Index (CPI) report for September, revealing a slight increase in inflation. The CPI rose 3% from the same time last year, marking a small rise from the previous 2.9% level. This development comes as the Federal Reserve prepares to lower interest rates again next week to shore up the labor market.

Key Highlights of the Report

- CPI Increase: The Consumer Price Index rose 3% year-over-year in September, slightly higher than expected.

- Core Inflation: Core inflation, excluding volatile food and energy prices, eased slightly to 3%, down from 3.1% in August.

- Monthly Price Increases: On a monthly basis, consumer prices overall rose 0.3%, while core goods and services increased by 0.2%.

- Government Shutdown Impact: The report’s release was delayed due to the government shutdown, which has forced the Bureau of Labor Statistics to suspend operations.

Factors Contributing to Inflation

Several factors have contributed to the recent uptick in inflation, including ¹:

- Tariffs: President Trump’s tariffs on imported goods have led to higher prices for a range of consumer goods, including furniture and apparel.

- Food Prices: Food prices have risen significantly this year, with coffee prices up nearly 19% despite a 0.1% decline in September.

- Energy Prices: Gasoline prices rose 4.1% in September, driven by a refinery shutdown in Indiana.

Federal Reserve’s Response

The Federal Reserve is expected to lower interest rates by a quarter of a percentage point next week, bringing rates down to a range of 3.75% to 4%. However, the task ahead for the Fed will be challenging, as officials must balance the need to control inflation with concerns about the labor market.

“The consumer is not necessarily strong enough to handle some of those big price increases,” said Veronica Clark, an economist at Citigroup. “Demand for workers is really low, and wages are going to keep slowing.”

Impact of Government Shutdown

The ongoing government shutdown has significant implications for the economy, as it disrupts the collection and analysis of critical economic data. October’s inflation and labor market data are not being collected or analyzed, which may lead to delayed reports in November.

“We’ll start to miss that data,” said Fed Chair Jerome Powell, adding that it will become “more challenging” as the shutdown drags on and additional data is not being collected.

Economic Outlook

The latest CPI report and government shutdown have raised concerns about the economic outlook. While some economists believe that the Fed’s actions will help stabilize the economy, others are worried about the potential for inflation to become stuck above the Fed’s target.

As the economy navigates these challenges, one thing is certain – the decisions made by the Federal Reserve and policymakers will have a significant impact on the future of the US economy.

FAQs on US Inflation and the Federal Reserve

Q: What is the current inflation rate in the US?

The annual inflation rate for the US is 3.0% for the 12 months ending September 2025, slightly higher than the previous rate of 2.9%.

Q: Why is the Federal Reserve keeping interest rates high?

The Fed is maintaining higher interest rates to combat inflation and ensure it meets its 2% target. However, with the labor market showing signs of slowing, the Fed is also considering the need to support economic growth.

Q: Will the Fed cut interest rates soon?

Yes, the Fed is expected to lower interest rates by a quarter of a percentage point at its next meeting, bringing rates down to a range of 3.75% to 4%. This decision aims to buoy a slowing job market while keeping inflation in check.

Q: How do tariffs impact inflation?

Tariffs imposed by the Trump administration have led to higher prices for consumer goods, contributing to inflation. Fed officials, including Fed Chair Jerome Powell, have expressed concerns about the potential for tariffs to drive up inflation.

Q: What is the impact of the government shutdown on economic data?

The government shutdown has disrupted the collection and analysis of critical economic data, including inflation and labor market reports. This disruption may make it challenging for the Fed to make informed decisions about monetary policy.

Q: How do Americans feel about the economy and inflation?

According to a Reuters/Ipsos poll, many Americans are worried about the cost of living, with 40% of respondents citing cost-of-living concerns as the single biggest factor in their vote next year. Healthcare costs are a top concern, with 31% of respondents saying lawmakers should prioritize addressing healthcare costs.

Q: What are the potential implications of the Fed’s decision on interest rates?

The Fed’s decision to lower interest rates could have several implications, including ¹ ²:

- Boosting Economic Growth: Lower interest rates could stimulate economic growth by making borrowing cheaper.

- Increasing Inflation: However, lower interest rates could also lead to higher inflation if the economy grows too quickly.

- Impact on Currency Markets: Changes in interest rates can also affect currency markets, influencing exchange rates and trade balances.

Q: What are the key factors influencing the Fed’s decision on interest rates?

The Fed’s decision on interest rates is influenced by various factors, including ²:

- Inflation Rate: The Fed’s primary objective is to keep inflation in check, and high inflation rates may lead to higher interest rates.

- Labor Market: The Fed also aims to support maximum employment, and a strong labor market may lead to higher interest rates.

- Economic Growth: The Fed considers the overall state of the economy, including factors like GDP growth and consumer spending.